How to Pay TDS For Property Purchase Online?

Last Updated on, April 12th, 2023

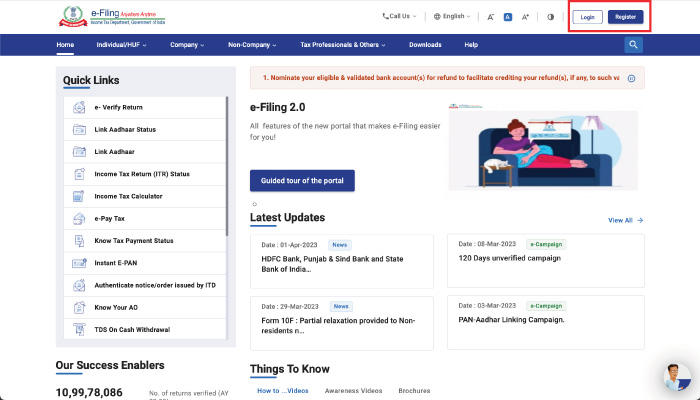

Step 1 – Open the Official Website of the Income Tax Department

Go to the official website of the income tax department –https://www.incometax.gov.in/iec/foportal/

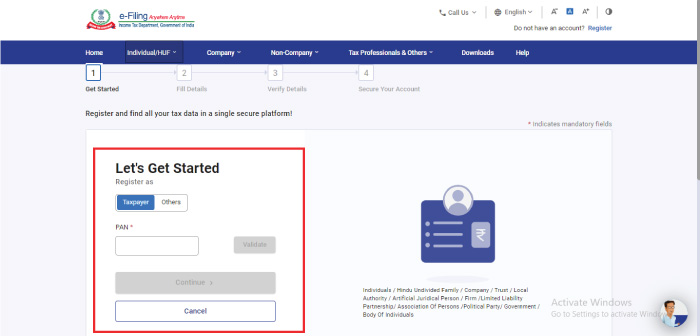

Step 2 – Register your account

In case you do not have a login ID, please register through your PAN number and generate a password for further login.

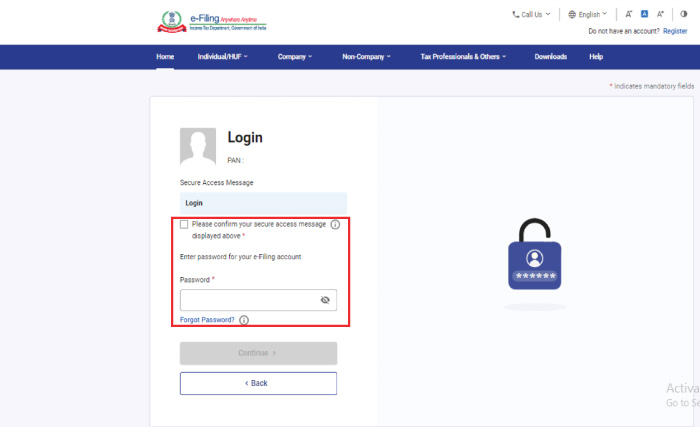

Step 3 – Login to your account

Login with your PAN number as a user ID and continue. Click on “Please confirm your secure access message displayed above” and “Continue” to log in to the portal.

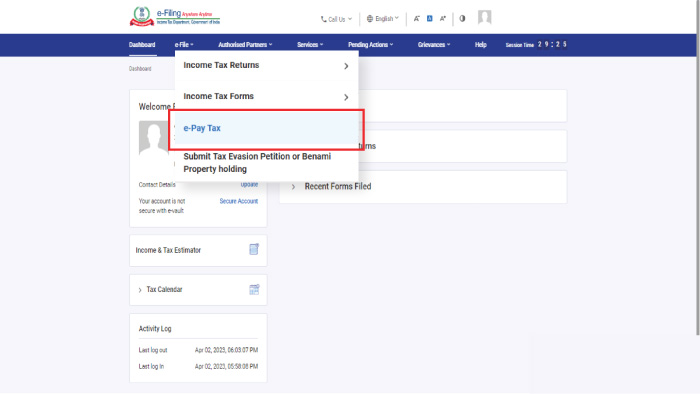

Step 4 – Select e-Pay Tax

Go to the “e-file” section and select “e-Pay Tax” from the dropdown menu.

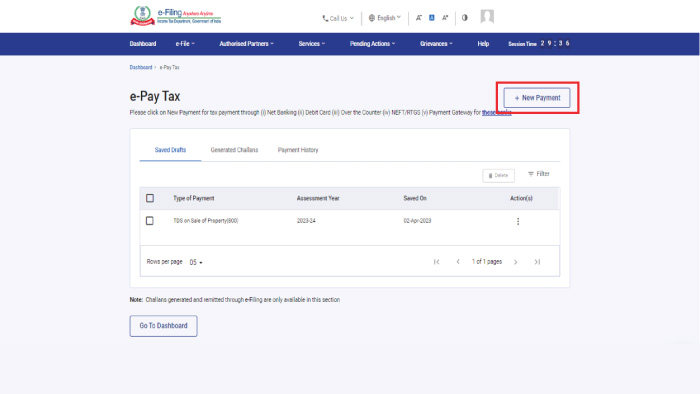

Step 5 – Select New Payment

Once that section loads, click on the “New Payment” button on the right side.

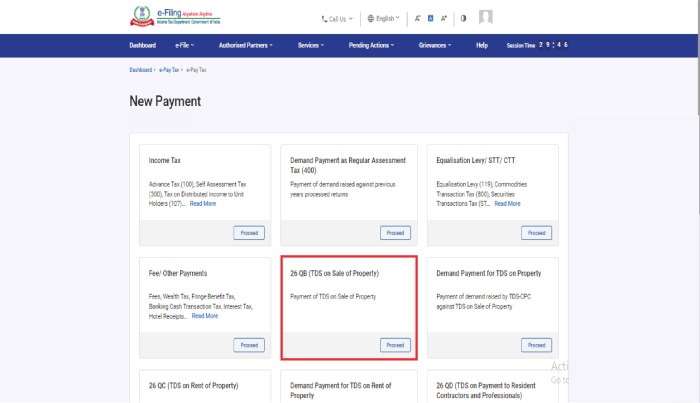

Step 6 – Select TDS on the Sale of the Property

Select “26 QB (TDS on Sale of Property) and proceed.

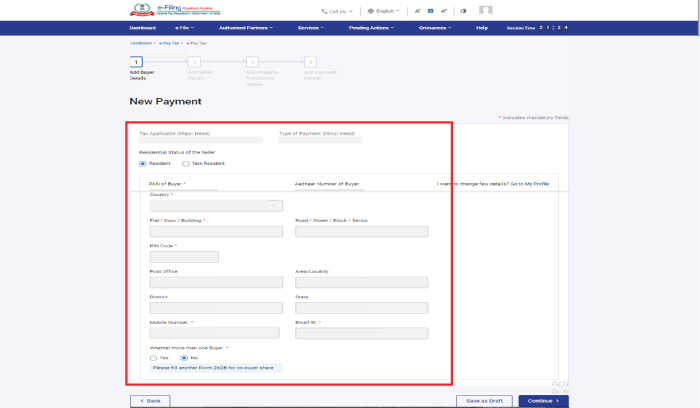

Step 7 – Fill in the Buyer Details

In the residential status of the buyer – Select “resident”. Fill in your (buyer’s) details such as your name, PAN number, address, mobile number, and email ID. In case there are multiple buyers, please select “YES”.

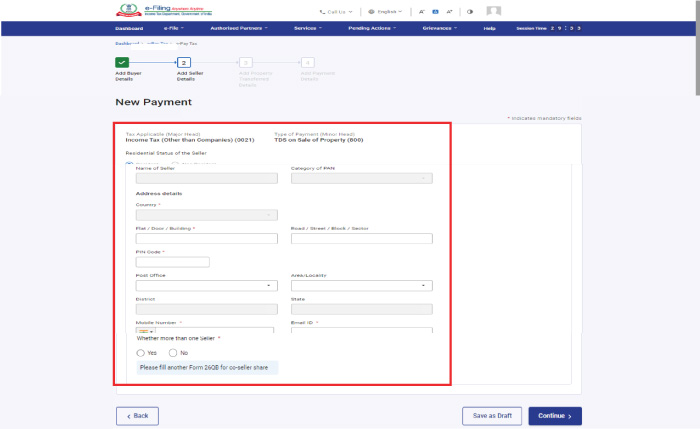

Step 8 – Fill in the Seller Details

Fill in the seller’s details such as the PAN number of the builder, address of the builder, mobile number and email ID. You can refer to our demand letter for all these details about Marathon. Select “No” to answer the question about “Whether more than one seller”

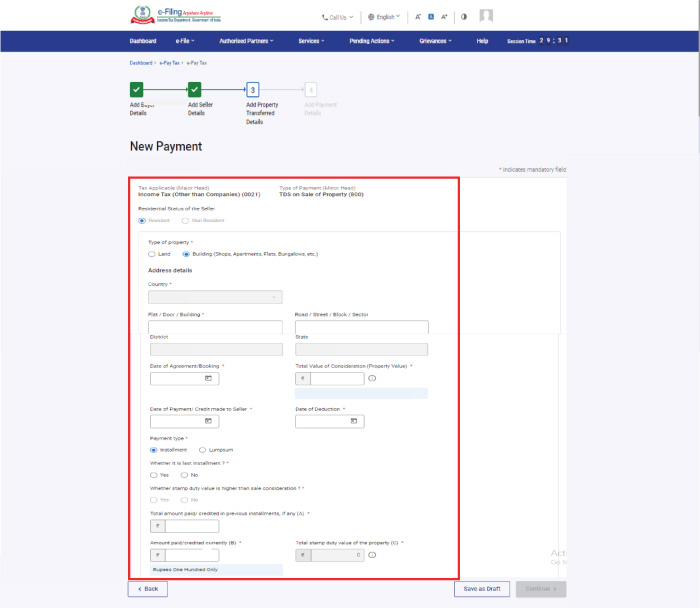

Step 9 – Fill in the Property & Payment Details

As a next step, you will have to enter the address of the property, agreement value, date of booking, date of payment, method of payment (instalment or lump sum), total amount paid in previous instalments and currently paid principal.

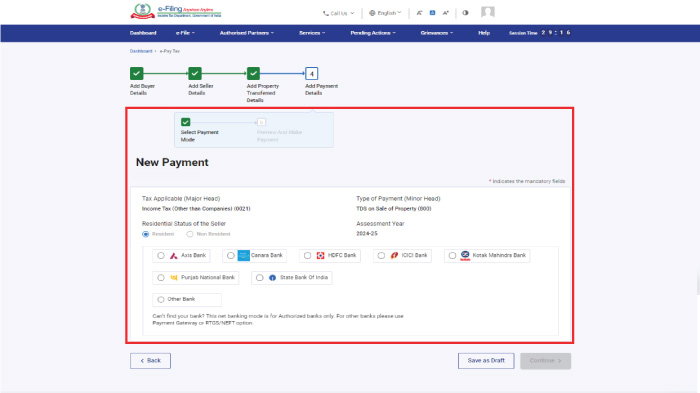

Step 10 – Select Payment Options

In the next step, select your payment option from a list of options displayed and proceed to the payment gateway.

Step 11 – Send us the TDS Receipt

Once you have made the payment, you will get a TDS receipt. You can email this TDS receipt to customercare@marathonrealty.com or Whatsapp us at 7677350350.