FAQ’s for home buyers

At Marathon, we consider ourselves your partners in your home buying journey. Whether or not you choose to buy a Marathon home, we want to help you make the right decision. This guide features important things to check while buying a home, tips, and more – we hope you find it useful.

Our Sales team is also available to assist you with any queries you may have. You can write to us at sales@marathonrealty.com

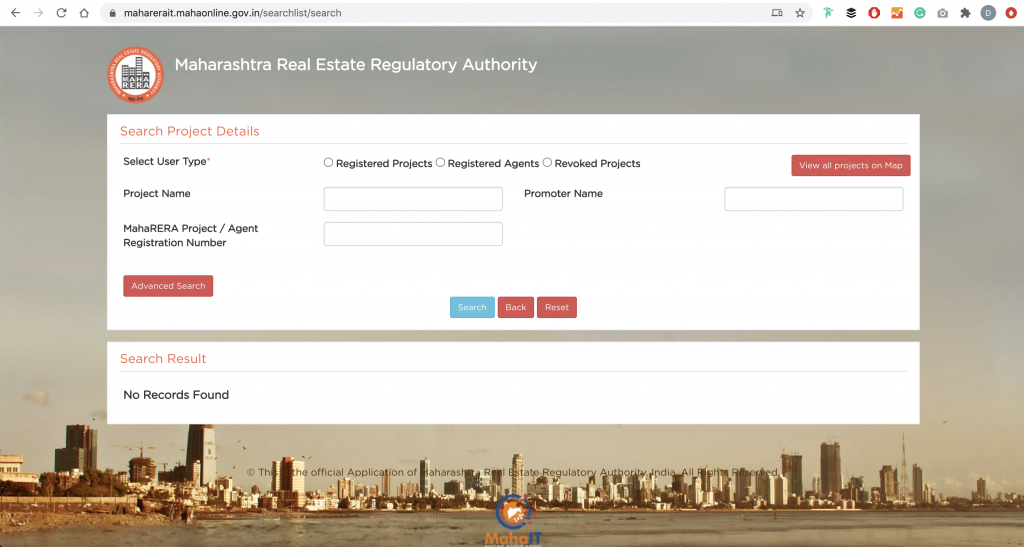

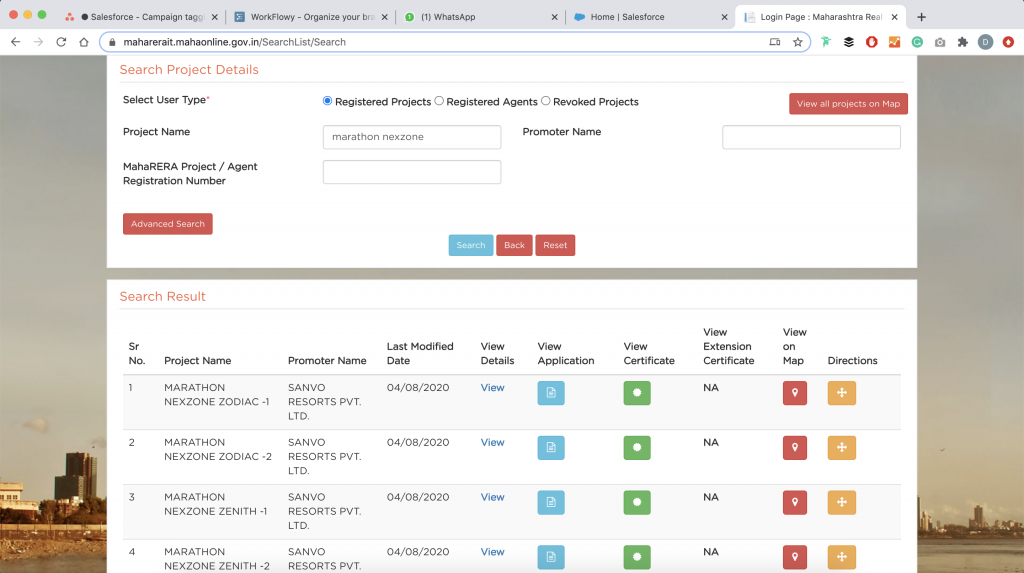

All our ongoing projects are registered under the Real Estate Regulatory Act (RERA). Checking RERA details of a project is an important step every buyer must do.

To check details visit – https://maharerait.mahaonline.gov.in/searchlist/search

- Click on registered projects and enter the project name

- You can also choose to click on map view , then locate the project on the google maps page (which has embedded links to all RERA registered projects)

- You can then view the project details, the application and the certificate

Make sure that the home you’re buying is RERA registered

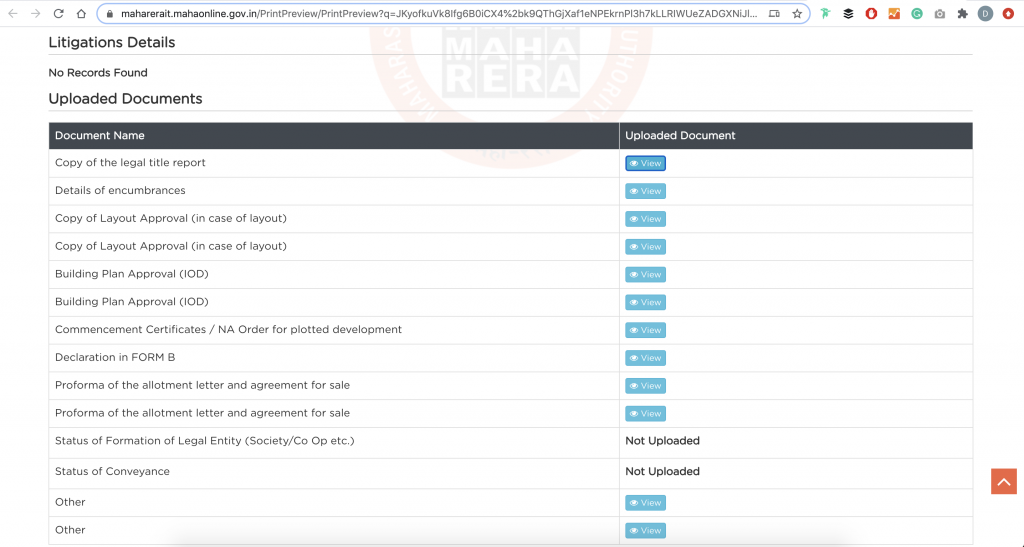

The details of approvals are available on the RERA website. Visit the project page click on ‘View Details’ and scroll down to the section called Uploaded Documents. You can find the commencement certificate, legal title report, building plan approval (IOD), layout approval and the draft agreement for sale.

According to the RERA, carpet area is defined as ‘the net usable floor area of an apartment, excluding the area covered by the external walls, areas under services shafts, exclusive balcony or verandah area and exclusive open terrace area, but includes the area covered by the internal partition walls of the apartment’.

RERA carpet area is a useful measure for clients but may differ from the useable carpet area of an apartment because it includes interior walls of the apartment and also excludes certain areas like enclosed balconies, terraces and some other useable areas

Useable carpet area is a measure that excludes walls and includes all the areas where you can spread a ‘carpet’.

The below diagrams illustrate the difference between useable and RERA carpet area.

For example, enclosed balcony is a technical term used in approvals. An enclosed balcony is actually a part of your room and is useable but is declared as a balcony that has been ‘enclosed’ in approvals for FSI concessions – this is perfectly valid and legal, however under the definition of RERA carpet area, this area is excluded even though it is a part of your useable carpet area.

Useable area is a more useful measure for you as a customer. While comparing projects, check the useable carpet area.

Our sales team will present you with all the available options when you visit the our experience centre. Depending on your budget and preferences our sales team will help you shortlist the apartment for selection.

While selecting an apartment, imagine how you would furnish the apartment if you stayed in it. Consider the following factors. These often involve trade-offs so decide what’s important for you and assign weightage accordingly.

- Overall size and number of rooms

- Size of each room as per how you plan to use it

- Views – decide if you’re comfortable with higher floors. Higher floors typically have more expansive views

- Storage space – cupboard niches, lofts etc.

- Kitchen size

- Number and size of toilets – this is important especially for families. Most of our 1BHK apartments have two toilets

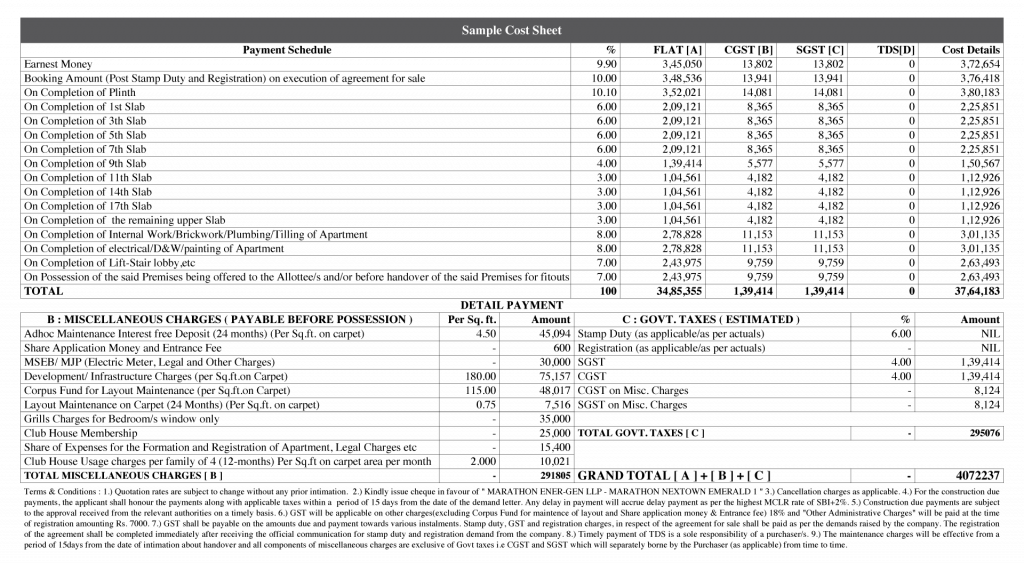

Your cost sheet has two main components – the break-up of your apartment cost and the payment schedule.

The all-inclusive apartment cost is broken up into the following components

- Agreement value

- Other charges

- Stamp duty and registration

- Taxes

Your payment schedule shows the various milestones and the amounts that will become due at each milestone

The agreement value is the amount mentioned in the agreement for sales. Taxes and stamp duty are computed on the agreement value of your apartment. The agreement value is typically computed as follows

Agreement value = (area * base rate) + floor rise premium + view premium + car park cost – any applicable discount

The above rates are not typically mentioned on the cost sheet and only the final computed agreement value is mentioned, you can ask your Sales Manager for details.

Yes, as per RERA covered car parkings are chargeable, the cost is included in your agreement value. Please ask the Sales Manager for a break-up of this cost.

Other charges are payable over and above the flat consideration and include charges like advance maintenance, maintenance deposits, legal charges, infrastructure charges, clubhouse membership and usage charges, corpus fund, electric and water meter charges, etc. These charges are provisional in nature at the time of booking and may increase due to increase in charges imposed by local bodies/government. Other charges typically paid at the time of the final milestone payable before handover of possession.

Please check your cost sheet and Agreement for Sale to understand which charges are applicable in your project for your flat as this may vary from project to project.

Advance Maintenance

This is charged for a certain period (1 year or 2 years for example). These funds are used maintenance of the project towards expenses like common area maintenance, repairs, common area electricity, lift maintenance salaries of security etc.

Layout maintenance

This is charged for a certain period (1 year or 2 years for example). These funds are used for the maintenance of the whole project layout towards expenses like common area maintenance, repairs, common area electricity, etc.

Corpus Fund

This is a deposit that gets transferred to the society upon conveyance of the said Project Land. The corpus fund is interest-free.

Advance Maintenance Deposit

This is similar to the corpus fund and shall be transferred to the society upon society conveyance after adjusting the outstanding dues (for example outstanding maintenance bills) of your flat.

Layout Maintenance Deposit

In case of a larger layout, this deposit shall be transferred to the Apex Body upon transfer of the layout land in favour of the Apex Body after adjusting the outstanding dues if any of the Allottee/s.

This charge goes towards development of the common infrastructure like roads, footpaths, common areas etc.

Clubhouse membership entitles you and your family (up to 4 persons) to membership of the clubhouse and is a one-time fee (The membership period may vary from project to project and is mentioned in your Agreement for Sale). Clubhouse usage are recurring charges that are typically charged annually.

This amount is used for electric and water connection infrastructure like meters, substations, receiving stations if any etc. These are provisional in nature and may increase, due to an increase in charges/deposits imposed by the concerned local bodies/government authority.

This amount is for the formation of society and the preparation of legal documents pertaining to society formation.

The other charges mentioned in your cost sheet are excluding taxes and you will be liable to pay the applicable taxes separately. Government taxes including GST will be charged as per then prevailing rate.