Complete Guide to Buying Under Construction Property

Last Updated on, June 29th, 2023

The journey to find your perfect home can be both exciting and overwhelming. From budgeting to choosing the type of property and understanding the nitty-gritty of property inspection, there are so many things to consider. Which property should you buy – under construction or ready to move in? How to check the legality of the property you buy? This blog is a detailed guide to buying under-construction properties and will provide you with answers to all these questions.

Go to>

Part 1: Under Construction vs Ready Property

Part 2: How to Set a Budget for Buying a Home?

Part 3: Check the RERA Details of a Property

Part 4: Understanding RERA Carpet Area, Built-Up Area and Super Built-Up Area

Part 5: Understanding the Concept of Cost Sheet

Under Construction vs Ready Property

Choosing between buying under-construction or ready-to-move-in property is the first thing that comes to our mind when hunting for a property. Both have pros and cons. The purpose and requirements of the property should be gauged to make a correct decision. Here are some points to consider:

Pros of Buying Under-Construction Property

1. Payment Flexibility

If you buy a ready property, you have to make the payment all at once or within a specific time frame, say 6 months. The under-construction property offers a lot of payment flexibility. You can register your house by paying a down payment of 5-10% and then make payments conveniently. This is typically called a construction-linked payment plan where payments are linked to the construction progress of your home.

2. Lower Cost

An under-construction property is cheaper than a ready-to-move-in. They are priced at a lower price per square foot compared to completed projects. The price difference can vary around 10-30%. This affordability is because of the pre-launch offers and discounts on on-site visits. Even if you’re a real estate investor, investing in under-construction property would offer a high appreciation. When the property is ready, you can sell it off and make handsome profits.

3. Better Construction Quality

Since under-construction properties are newer in nature, the technology used behind constructing them is robust. Advanced building materials like high-strength concrete and energy-efficient insulation are used to enhance the durability and energy efficiency of the property. You can be assured of top-notch quality in under-construction property compared to a ready property in a 30-40-year-old building that is dilapidated and requires frequent maintenance and repair.

4. More Options to Choose From

In under-construction property, a wide range of options are available to buyers. Even if a particular property gets sold out, you can select a similar unit on a different floor or different wing of the building. The ample inventory of under-construction projects ensures that buyers have a high chance of finding their desired property.

Cons of Buying Under-Construction Property

1. High Risk

There are often cases when builders do not deliver properties on time or they go bankrupt and do not deliver the property at all. This is the biggest disadvantage of investing in under-construction property. Hence, before investing in an under-construction property, it would be wise to check the background and track record of the builder.

2. Discrepancy in Final Product

Another frequent issue of buying under-construction property is not getting what you were promised. Some of the common inconsistencies include discrepancies in area, the layout of the home and scarcity of amenities.

Pros of Buying Ready Property

1. You Get What You See

The fact that you get what you see is one of the biggest benefits of buying ready-to-move-in property. You can take multiple site visits to evaluate the final quality of the property. Unlike under-construction property, there is absolutely no chance that the area of the property or its layout will differ.

2. No GST Implications

When you buy a ready property, you need not pay any GST, unlike under-construction property which attracts a GST of 5-12% depending on the type of property you buy.

3. Immediate Availability

One of the most sought-after things about buying ready property is its immediate availability, unlike under-construction property where you have to wait till possession. Once you complete your payment, the property is all yours. You can move in even the next day or give it on rent.

When choosing between under-construction and ready properties, it is important to weigh the pros and cons of both. However, the pros of under-construction properties outweigh ready to move in. Lower cost of the property leads to affordable home ownership, high appreciation can lead to substantial financial gains, and compliance with RERA regulations ensures transparency and safeguards the buyers’ interest.

You can even watch this video to dive into this topic further.

How to Set a Budget for Buying a Home?

When buying a property, it is important to factor in other costs such as GST, stamp duty ad registration which are over and above your property costs. Here are a few steps for creating a home buying budget for under construction home.

1. Checking Home Loan Eligibility

For salaried employees, this is a straightforward process. If your gross monthly salary is 1,00,000, most banks consider 60% of your gross monthly salary as your EMI payment capacity.

However, different banks have different eligibility criteria. Loan tenors and rates also vary. For self-employed, home loan eligibility depends on various factors like net profit, gross margin and income estimation. You can check with a banker for accurate calculations.

2. Get a Pre-Loan Sanction

It is recommended to get a home loan pre-sanctioned from a bank. A pre-sanction is an in-principle sanction based on your income eligibility before you have identified the property. Most banks have a very easy pre-sanction process where you need to submit a few basic documents like salary slips, bank statements, IT returns and KYC. Some banks even have an online approval process. It is important to get a pre-sanction since that will enable you to find out the exact loan amount

3. Affordability vs Eligibility

Remember, affordability is more important than eligibility. While you may be eligible for a higher home loan, you should step back and think if you can afford a high EMI. Consider your other expenses like rent payments, utility bills, insurance premiums, taxes, etc.

Other than this, you should at least have 10-20% of the flat cost in the personal savings to pay for expenses like stamp duty, and GST which banks may not fund.

Watch this video to further understand this concept with the help of an example.

Check the RERA details of a property

If you’re buying an under-construction property, only buy properties that are RERA-registered. RERA ensures that developers adhere to strict project timelines and deliver what they promise. Moreover, RERA provides a platform for buyers to seek redressal in case of disputes or grievances, ensuring a fair and balanced approach. Overall, investing in a RERA-registered property offers buyers peace of mind and security as RERA confirms the legality of the project. It has played a critical role in regulating the under-construction real state industry.

Each project has its unique RERA number, You can find the history of that project using its RERA number.

Here’s how you can check RERA details:

1. Visit the official RERA website.

2. You can view all the project details like the Promoter’s name, Date of Possession and any litigations related to the project.

3. You can even access various approvals received by the project such as commencement certificate, legal title report, building plan approval and other documents.

Understanding RERA Carpet Area, Built-Up Area and Super Built-Up Area

When you’re buying a home, it’s important to know what you’re getting for the money you are paying. Hence, it’s crucial to understand the terms like RERA carpet area, built-up area and super built-up area as all these terms are used to define the area and size of an apartment.

RERA Carpet Area

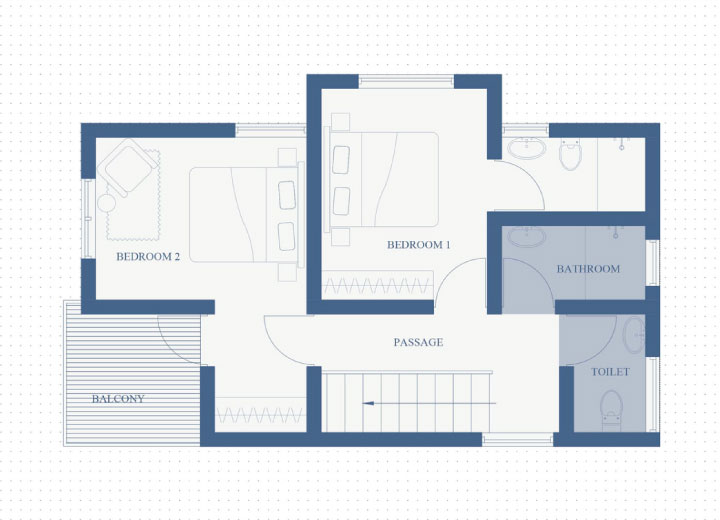

RERA Carpet area is the net useable floor area of an apartment, excluding the area covered by external walls, the area under service shafts, the exclusive balcony or verandah area, and the exclusive open terrace area but includes the area covered by internal partition walls of the apartment.

While the RERA carpet area is important, the usable area is an even more important metric as it shows the actual space you will be getting.

Under the RERA Act, the developers are now bound to mention the carpet area and charge prices based on the carpet area and not the super built up area.

Built-Up Area

The built-up area of your flat is the carpet area, along with the area covered by inner walls and the balcony. It includes unusable areas like balconies, flower beds, terraces, etc.

Super Built-Up Area

The super built-up area is the net saleable area that includes carpet area along with a proportion of the areas covered by lift, balcony, wall, terrace and staircase. In some cases, standard amenities like a swimming pool, garden and clubhouse are also included in the super built-up area. The loading factor on the carpet area is used to measure the super built-up area.

Understanding the Concept of Cost Sheet

A cost sheet is a document that lists various expenses and financial details associated with purchasing an under-construction property. A cost sheet has two main components – the breakup of your apartments costs and the payment schedule. Cost sheet plays a crucial role in ensuring transparency and helping buyers make informed decisions about their financing options.

Conclusion

In this detailed guide, we have tried to cover all aspects of home buying. By following this guide, you can gain valuable insights into the intricacies of the home-buying process and make informed decisions.