RBI measures in the wake of COVID-19

Last Updated on, October 27th, 2022

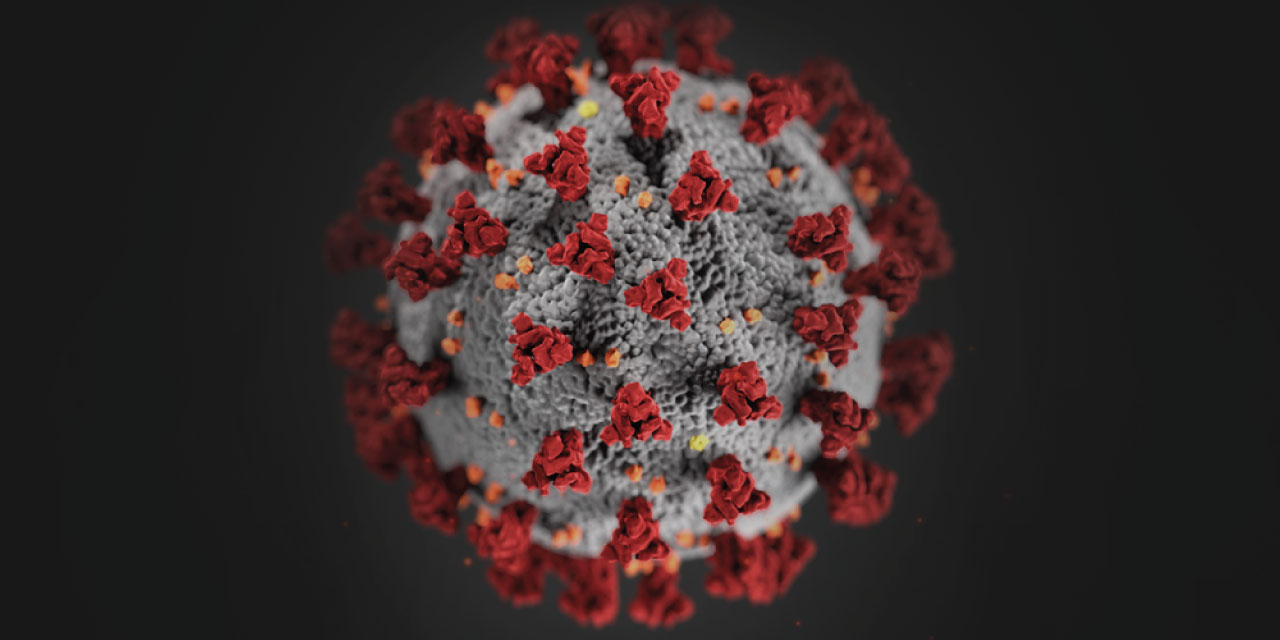

With COVID-19 sweeping the world, major economic reforms were the need of the hour to keep the economy chugging along. The RBI, on. Friday, joined governments across the world in announcing packages to provide stimulus to the global economy.

The RBI has taken drastic measures, with the Governor, Shantikanta Das saying “Clearly, a war effort has to be mounted and is being mounted to combat the virus, involving both conventional and unconventional measures in continuous battle-ready mode.”

“At a time of such pandemic, the government is making substantial liquidity infusions into the economy, has been very supportive, and taking requisite measures to maintain economic equilibrium”

– Mayur Shah, MD, Marathon Group

Here are some of the measures that the RBI announced to ensure liquidity and minimise the effects of the Novel Coronavirus on the economy

- Reduction in Repo rate: Repo rate is the rate at which the RBI lends funds to banks. This rate has been reduced by 75 basis points or (.75%). This reduction in the rate will be passed on to the end customers as a reduction in the interest rate of their loans

- Reduction in Reverse Repo Rate: The Reverse Repo Rate is the rate of interest the RBI pays banks for their deposits. This rate was reduced by 90 basis points (.9%) in a move aimed at dis-incentivising banks from depositing their capital and lending it out in the market to improve liquidity.

- 3 month loan deferment: The RBI has announced a 3 month moratorium for home loans, car loans and other mortgages to help people who have been negatively affected by the crisis. Opting for the loan deferment will not result in a degradation of credit scores. This is aimed at ensuring minimisation of NPA’s.

- Reduction in Credit Reserve Ratio: The CRR is the ratio of the amount to be deposited with the RBI to the outstanding loans of a bank. This ratio has been reduced by 100 basis points (1%) to ensure better liquidity in the market.

- In addition to these measures, the RBI has also increased long term funding to financial institutions and made it easier to get overnight credit.

These measures are aimed at propping up the economy to ensure minimal disruptions in these troubled times. With these measures in place, all loans, including home loans will get significantly cheaper. This, along with the lacklustre performance and turbulence in the stock market, makes it an ideal time to invest in real estate.

To read more about Marathon Group’s response to the COVID-19 pandemic click here

To learn more and contribute to the cause click here